Sewing threads are basic element of making any kind of apparel so it it highly needed to calculate actual consumption for making any item. Today's market is very competitive so merchandiser's should give attention on thread consumption also. Sometimes merchandiser's ignore this issue with little importance but for sustainable business policy you have to maintain accuracy in all portions and ensure the least wastage as well.

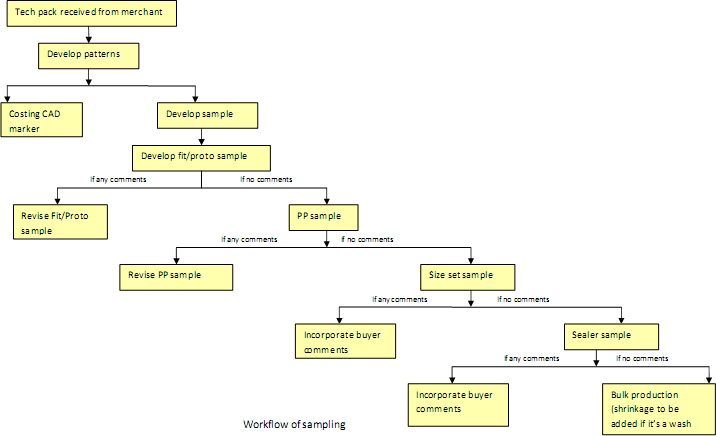

There is a basic formula for doing this thing with less effort and time.In that formula you will get multiplying factors according to machine type and stitch class. To determine thread consumption you just need to multiply seam length with that factors. This way one can estimate total thread requirement for making a garment.

Thread consumption depends on following factors-

The standard formula belongs according to the below procedures...

Thread consumption ratios as per coats international:

Some basic consumptions are given below:

There is a basic formula for doing this thing with less effort and time.In that formula you will get multiplying factors according to machine type and stitch class. To determine thread consumption you just need to multiply seam length with that factors. This way one can estimate total thread requirement for making a garment.

Thread consumption depends on following factors-

- Style of the garment

- Types of stitch used

- Stitch per inch (SPI)

- Garments size/measurements

- Seam thickness

- Thread tension

- Thread count

The standard formula belongs according to the below procedures...

- Find out stitches of various classes

- Measure the length of each type of stitch

- Measure the length of sewing thread/inch stitch

- Calculate total thread in length for each stitch

- Summarized the total thread for all stitches

Thread consumption ratios as per coats international:

Some basic consumptions are given below:

|

Item

|

Thread Consumption

per body

|

|

Basic t-shirt

|

125 mtr

|

|

Basic polo shirt

|

180 mtr

|

|

Basic long sleeve shirt

|

150 mtr

|

|

Basic short sleeve woven shiirt

|

125 mtr

|

|

Basic shorts

|

350 mtr

|

|

Classic short

|

450 mtr

|

|

Basic long pants

|

350 mtr

|

|

Classic long pants

|

450 mtr

|

|

Basic short all

|

350 mtr

|

|

Basic overall

|

400 mtr

|

|

Padded coverall

|

450 mtr

|

|

Basic romper

|

200 mtr

|

|

Skirt

|

300 mtr

|

|

Panty

|

50 mtr

|

|

Brief

|

100 mtr

|

|

Brassier

|

150 mtr

|

|

Tank top

|

50 mtr

|

|

Denim 5pkt pant

|

400 mtr

|

|

Denim jacket

|

450 mtr

|

|

Twill jacket

|

450 mtr

|

Sewing Thread Consumption Procedure | Thread Calculation for Garments Costing

Advertisements

Sewing threads are basic element of making any kind of apparel so it it highly needed to calculate actual consumption for making any item. Today's market is very competitive so merchandiser's should give attention on thread consumption also. Sometimes merchandiser's ignore this issue with little importance but for sustainable business policy you have to maintain accuracy in all portions and ensure the least wastage as well.

There is a basic formula for doing this thing with less effort and time.In that formula you will get multiplying factors according to machine type and stitch class. To determine thread consumption you just need to multiply seam length with that factors. This way one can estimate total thread requirement for making a garment.

Thread consumption depends on following factors-

The standard formula belongs according to the below procedures...

Thread consumption ratios as per coats international:

Some basic consumptions are given below:

There is a basic formula for doing this thing with less effort and time.In that formula you will get multiplying factors according to machine type and stitch class. To determine thread consumption you just need to multiply seam length with that factors. This way one can estimate total thread requirement for making a garment.

Thread consumption depends on following factors-

- Style of the garment

- Types of stitch used

- Stitch per inch (SPI)

- Garments size/measurements

- Seam thickness

- Thread tension

- Thread count

The standard formula belongs according to the below procedures...

- Find out stitches of various classes

- Measure the length of each type of stitch

- Measure the length of sewing thread/inch stitch

- Calculate total thread in length for each stitch

- Summarized the total thread for all stitches

Thread consumption ratios as per coats international:

Some basic consumptions are given below:

|

Item

|

Thread Consumption

per body

|

|

Basic t-shirt

|

125 mtr

|

|

Basic polo shirt

|

180 mtr

|

|

Basic long sleeve shirt

|

150 mtr

|

|

Basic short sleeve woven shiirt

|

125 mtr

|

|

Basic shorts

|

350 mtr

|

|

Classic short

|

450 mtr

|

|

Basic long pants

|

350 mtr

|

|

Classic long pants

|

450 mtr

|

|

Basic short all

|

350 mtr

|

|

Basic overall

|

400 mtr

|

|

Padded coverall

|

450 mtr

|

|

Basic romper

|

200 mtr

|

|

Skirt

|

300 mtr

|

|

Panty

|

50 mtr

|

|

Brief

|

100 mtr

|

|

Brassier

|

150 mtr

|

|

Tank top

|

50 mtr

|

|

Denim 5pkt pant

|

400 mtr

|

|

Denim jacket

|

450 mtr

|

|

Twill jacket

|

450 mtr

|

Advertisements