Historical Background of Garment Industry in Bangladesh | Current Data On Export of Garments(Woven and Knit)

Brief History:

Bangladesh is a developing country where textile and garment industries provide the single source of economic growth in its rapidly developing economy.

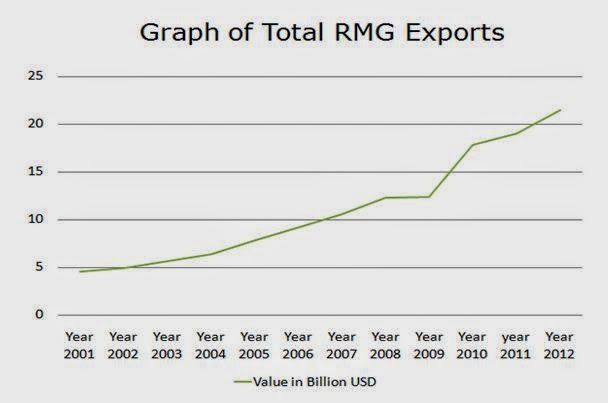

Textiles, Clothing and RMG cover about 77% of total exports. About 4 million people, most of them are women, work to this sector, earned 21.51 billion USD in the Fiscal Year 2012-13 (Source-Export promotion bureau).

Bangladesh started its first export oriented garment industry in 1977 as Desh Garments Ltd. Which was a joint venture with Daewoo (south Korea). Meanwhile many Bangladeshi’s took training for RMG business from Korea, then established new factories with local investors. Bangladesh was made its first shipment of woven garment in 1977. (Wikipedia, BKMEA Website)

Sixty percent of the export contracts of western brands are with European buyers and about forty percent with the American buyers. WTO declared Bangladesh as the 2nd Largest garment exporters after china in FY 2011-12, whereas it is becoming 2nd largest Denim exporters across the world but it is only 4.8% of the global RMG trade of $412 billion (Source-Wikipedia, seagroupbd & denimandjeans).

Contribution of Woven and knit garment is almost similar, respectively 41% and 39% of total export, where 80 percent knit garment goes to Europe market and here retention is almost 60%. (BKMEA Website)

1950 was the beginning of RMG in the Western world. In order to control the level of imported RMG products from developing countries into developed countries, the Multi Fibre Agreement (MFA) was made in 1974. The MFA agreement imposed an export rate 6 percent increase every year from a developing country to a developed country. In the early 1980s Bangladesh started receiving investment in the RMG sector. Some Bangladeshis received free training from the Korean Company Daewoo. After these workers came back to Bangladesh, many of them broke ties with the factory they were working for and started their own factories.

Bangladesh Textile and Garment Industry Highlights:

Bangladesh enters 2013 with a firm footing as the world's second largest garment exporter, raising hopes for a new wave of business despite turbulent times in parts of the globe.

The World Trade Organization (WTO) declared Bangladesh as the second largest RMG exporter after China in 2010-11 when the country's export grew 43.36 percent year on year to $15.66 billion in spite of global recession in 2007-2008.

Bangladesh retained its position in the following fiscal 2011-12 by exporting garments worth $19.09 billion. And the outlook for the current fiscal is set to exceed $20 billion.Bangladesh now claims 4.8 percent of the global RMG trade of $412 billion.

According to McKinsey & Company, an international management-consulting firm, Bangladesh's apparel exports will reach $36 billion by 2020.But all these prospects appear to have been shaken by one fire tragedy in late November at Tazreen Fashions Ltd, where 112 workers were killed. This single incident exposed inadequate fire safety and poor working conditions that still exist in many factories.

On April 24 1137 textile workers factories making clothes for Western brands, were killed when a garment factory collapsed. The Savar building collapse was in the Rana Plaza complex, in Savar, an industrial corner 20 miles northwest of Dhaka, the capital of Bangladesh.The incident was widely covered worldwide mainly because of Bangladesh's position as the number two apparel exporter. The buyers are now pressing factory owners to improve working conditions, hike wages of workers, and ensure labour rights and other compliance issues.The strength of the country's apparel sector is well understood through its ability to supply high-end items to famous global brands such as Hugo Boss, Adidas, Puma, Tommy Hilfiger, G-Star, Diesel, Ralph Lauren, Calvin Klein, DKNY, Nike, Benetton and Mango. Currently, more than 30 percent of the total RMG export is high-end products.The primary textile sector also saw a wave of investments for increasing demands for fabrics. The sector with a total investment of over 4.5 billion pounds is now capable of supplying 90 percent of fabrics for the knitwear sub-sector and 40 percent of fabrics for the woven sub-sector.

The country has more than 5,500 woven garment factories, 1,700 knitwear factories and 1,300 spinning, finishing and dyeing factories. At present, the sector employs 3.5 million workers, 80 percent of whom are women.The country's 60 percent RMG products enter the EU, 23 percent goes to the USA, 4.8 percent to Canada and 12.1 percent to other destinations worldwide. Bangladeshi Knitwear is exported to 93 countries of the world where EU and the USA are the major importers.

According to data of Export Promotion Bureau, the RMG sector's contribution to the country's export was 3.9 percent in fiscal 1983-84, which now stands at nearly 80 percent. The core strength of the knitwear sector is its backward linkage. The entrepreneurs of the sector not only increased their stitching capacity overtime but also invested in the allied industry to augment the overall capacity of the total sector with the same pace. Over the period of time knitwear sector gradually became almost self sufficient in fabric and yarn. This improvement has become possible because of the integrated growth of spinning factories in line of the growth of country's stitching capacity and increased need of the yarn and fabric. As the export increased in the knitwear sector, the capacity of backward linkage also increased accordingly.The result is local suppliers can provide now 95% of the total fabric requirement of the sector (source: BTMEA).

The growth of spinning mills also stepped with the growth of knitwear exports. In 2010-11 total number of Yarn Manufacturing Member Mills was 383, whereas Fabric Manufacturer Member Mills was 743.As of now the total investment in the backward linkage in knitting, dyeing and spinning industry is more than US$ 5.03 billion or € 4.00 billion.Knitwear is the highest contributor in terms of both gross and net export earnings. In 2010-11, the contribution of knitwear in national export earnings is 41.36%. This has resulted because of the backward linkage industry that has grown over time which helped the knitwear sector to have the higher value addition and therefore a much higher net retention rate. In addition to, relaxation of Rules of Origin (RoO) has accelerated the export growth.There are more than 261 composite knitwear factories in Bangladesh, currently listed with Bangladesh Knitwear Manufacturers & Exporters Association (BKMEA) who are supplying 95% of the knit fabric requirements of the sector.Local spinners supply yarn to fulfill around 75% of the total requirement of yarn for this industry.

The Bangladesh Knitwear industry is highly competitive where most of the knit composites have similar manufacturing capabilities. However, there are about 50 to 60 factories which are fully compliant and offer slight product differentiation and offer large capacity to the high volume buyers who source high quality goods at competitive prices within this region.

Over the decades the growth of knitwear sector has been incessant rising over 20% at CAGR base and continuously grabbing more portions in the export pie of Bangladesh. This recent robust growth is partly achieved owing to preferential support from the European Commission’s GSP & Relaxation of Rules of Origin (ROO) and the Duty Free Quota Free (DFQF) access granted by Canada, Australia, Japan and members of European Free Trade Agreement (EFTA). Along this growth momentum favorable policies from the government of Bangladesh in the form of export subsidies i.e. cash incentives also contributed greatly for making it the most attractive sourcing hub.

Statistical Data of Textile & Garment Industry of Bangladesh:

According to the statistics of BGMEA, BKMEA and Bangladesh Hand Loom Board, Bangladesh has the below established factory.

Industry Type Total Established Industry

Spinning Mills 400

Weaving Mills 1500

Knit Composite 1700

Garment Industry 5600

Hand Loom Unit 0.183 Million

According to BGMEA, BKMEA and Export Promotion Bureau Bangladesh has exported the below in the previous 12 years.

Traditionally, the exports basket of Bangladesh has been leaning towards EU and the USA. So far the EU is the largest destination for Bangladesh knitwear, worth of value $7.3 billion with share of 69.74% exported in the year 2012-13 followed by the USA with $1.13 billion and a share of 10.79%. The one-stage transformation requirement of ROO in 2011 boosted signs for market penetration in the EU further; hence a growth of 46.63% in the FY 2010-11 over 2009-10 was remarkably noticeable.

Bangladesh RMG sector mainly comprises of Knit and woven garments competing vigorously to surpass each other for taking up the leadership yoke within the economy. It was in FY 2003-04 the knit garments for the first time exceeded woven wear and became the leader in terms of quantity exports with 91.6 million dozens as against 90.48 million dozens of woven garments. And from FY 2007-08, knitwear continues to widen the gap with woven both in terms of value and quantity. To the end the RMG sector, engine of our economic growth, has largely compensated with evolutionary mechanism in the overall designing of factory management - successfully leaving aside all the bottlenecks and making the economy a resilient one despite of natural disasters, poor infrastructure, weak governance and political turbulence.

Get Updates

Subscribe to our e-mail newsletter to receive updates.

Share This Post

Related posts

0 comments: