A Letter of Credit is a payment term generally used for international sales transactions. It is basically a mechanism, which allows importers/buyers to offer secure terms of payment to exporters/sellers in which a bank (or more than one bank) gets involved. The technical term for Letter of credit is 'Documentary Credit'. At the very outset one must understand is that Letters of credit deal in documents, not goods. The idea in an international trade transaction is to shift the risk from the actual buyer to a bank. Thus a LC (as it is commonly referred to) is a payment undertaking given by a bank to the seller and is issued on behalf of the applicant i.e. the buyer. The Buyer is the Applicant and the Seller is the Beneficiary. The Bank that issues the LC is referred to as the Issuing Bank which is generally in the country of the Buyer. The Bank that Advises the LC to the Seller is called the Advising Bank which is generally in the country of the Seller.

A Letter of Credit is a payment term generally used for international sales transactions. It is basically a mechanism, which allows importers/buyers to offer secure terms of payment to exporters/sellers in which a bank (or more than one bank) gets involved. The technical term for Letter of credit is 'Documentary Credit'. At the very outset one must understand is that Letters of credit deal in documents, not goods. The idea in an international trade transaction is to shift the risk from the actual buyer to a bank. Thus a LC (as it is commonly referred to) is a payment undertaking given by a bank to the seller and is issued on behalf of the applicant i.e. the buyer. The Buyer is the Applicant and the Seller is the Beneficiary. The Bank that issues the LC is referred to as the Issuing Bank which is generally in the country of the Buyer. The Bank that Advises the LC to the Seller is called the Advising Bank which is generally in the country of the Seller.The specified bank makes the payment upon the successful presentation of the required documents by the seller within the specified time frame. Note that the Bank scrutinizes the 'documents' and not the 'goods' for making payment. Thus the process works both in favor of both the buyer and the seller. The Seller gets assured that if documents are presented on time and in the way that they have been requested on the LC the payment will be made and Buyer on the other hand is assured that the bank will thoroughly examine these presented documents and ensure that they meet the terms and conditions stipulated in the LC.

Typically the documents requested in a Letter of Credit are the following:

1.L/c application from

2.Valid trade license.

3.Import registration corticated (lrc)

4.Tin or inmates declaration

5.Memorandum of association

6.Indent pr Performa Invoice

7.Photographs

8.Bank gurrntee certificate

9.Agreement form

10.Insurance coverage

11.Commercial invoice

12.Transport document such as a Bill of lading or Airway bill,

13. Insurance document;

14.Inspection Certificate

15.Certificate of Origin

But there could be others too.

Letters of credit (LC) deal in documents, not goods. The LC could be 'irrevocable' or 'revocable'. An irrevocable LC cannot be changed unless both the buyer and seller agree. Whereas in a revocable LC changes to the LC can be made without the consent of the beneficiary. A 'sight' LC means that payment is made immediately to the beneficiary/seller/exporter upon presentation of the correct documents in the required time frame. A 'time' or 'date' LC will specify when payment will be made at a future date and upon presentation of the required documents.

Essential Principles Governing Law Within the United States, Article 5 of the Uniform Commercial Code (UCC) governs L/Cs. Article 5 is founded on two principles:

(1) the L/C,s independence from the underlying business transaction, and

(2) strict compliance with documentary requirements.

1) Strict Compliance

How strict compliance? Some courts insist upon literal compliance, so that a misspelled name or typographical error voids the exporter's/beneficiary's/seller's demand for payment. Other courts require payment upon substantial compliance with documentary requirements. The bank may insist upon strict compliance with the requirements of the L/C. In the absence of conformity with the L/C, the Seller cannot force payment and the bank pays at its own risk. Sellers should be careful and remember that the bank may insist upon strict compliance with all documentary requirements in the LC. If the documents do not conform, the bank should give the seller prompt, detailed notice, specifying all discrepancies and shortfalls.

2) The Independence Doctrine

Letters of credit deal in documents, not goods. L/Cs are purely documentary transactions, separate and independent from the underlying contract between the Buyer and the Seller. The bank honoring the L/C is concerned only to see that the documents conform with the requirements in the L/C. If the documents conform, the bank will pay, and obtain reimbursement from the Buyer/Applicant. The bank need not look past the documents to examine the underlying sale of merchandise or the product itself. The letter of credit is independent from the underlying transaction and, except in rare cases of fraud or forgery, the issuing bank must honor conforming documents. Thus, Sellers are given protections that the issuing bank must honor its demand for payment (which complies with the terms of the L/C) regardless of whether the goods conform with the underlying sale contract.

3 Most Common Reasons why Letters of Credit Fail

1) Time Lines:

The letter of credit should have an expiration date that gives sufficient time to the seller to get all the tasks specified and the documents required in the LC. If the letter of credit expires, the seller is left with no protection. Most LC s fail because Sellers/Exporters/Beneficiaries were unable to perform within the specified time frame in the LC. Three dates are of importance in an LC:

a) The date by when shipment should have occurred. The date on the Bill of Lading.

b) The date by when documents have to be presented to the Bank

c) The expiry date of the LC itself.

A good source to give you an idea of the timelines would be your freight forwarding agent. As a seller check with your freight forwarding agent to see if you would be in a position to comply.

2) Discrepancy within the Letter of Credit:

Letters of credit could also have discrepancies. Even a discrepancy as small as a missing period or comma can render the document invalid. Thus, the earlier in the process the letter of credit is examined, the more time is available to identify and fix the problem. This is another common reason why LCs fail.

3) Compliance with the Documents and Conditions within the Letter of Credit.

Letters of credit are about documents and not facts; the inability to produce a given document at the right time will nullify the letter of credit. As a Seller/Exporter/Beneficiary you should try and run the compliance issues with the various department or individuals involved within your organization to see if compliance would be a problem. And if so, have the LC amended before shipping the goods.

Learning the Terminology of Exporting

INCOTERMS (TRANSPORTATION)

Shipping terms set the parameters for international shipments, specify points of origin and destination, outline conditions under which title is transferred from seller to buyer, and determine which party is responsible for shipping costs. They also indicate which party assumes the cost if merchandise is lost or damaged during transit. To provide a common terminology for international shipping, INCOTERMS (International Commercial Terms) have been developed under the auspices of the International Chamber of Commerce.

All letters of credit contain these elements:

- A payment undertaking given by the bank (issuing bank)

- On behalf of the buyer (applicant)

- To pay a seller (beneficiary)

- A given amount of money

- On presentation of specified documents representing the supply of goods

- Within specific time limits

- These documents conforming to terms and conditions set out in the letter of credit

- Documents to be presented at a specified place.

The stages of the letter of credit:

1. Buyer and seller agree terms, including means of transport, period of credit offered (if any), latest date of shipment, Incomer to be used

2. Buyer applies to bank for issue of letter of credit. Bank will evaluate buyer's credit standing, and may require cash cover and/or reduction of other lending limits

3. Issuing bank issues L/C, sending it to the Advising bank by airmail or (more commonly) electronic means such as telex or SWIFT

4. Advising bank establishes authenticity of the letter of credit using signature books or test codes, then informs seller (beneficiary). Advising bank MAY confirm L/C, i.e. add its own payment undertaking

5. Seller should now check that L/C matches commercial agreement, and that all its terms and conditions can be satisfied, (e.g. all documents can be obtained in good time.) If there is anything that may cause a problem, an AMENDMENT must be requested.

6. Seller ships the goods, then assembles the documents called for the L/C (invoice, transport document etc.) Before presenting the documents to the bank, the seller should check them for discrepancies with the L/C, and correct the documents where necessary.

7. The documents are presented to a bank, often the Advising bank. The Advising bank checks the documents against the L/C. If the documents are compliant, the bank pays the seller and forwards the documents to the Issuing bank

8. The Issuing bank now checks the documents itself. If they are in order (and it is a sight L/C), it reimburses the seller's bank immediately

9. The Issuing bank debits the buyer and releases the documents (including transport document), so that the buyer can claim the goods from the carrier.

Different kinds of L/C :

1. Revocable L/C/irrevocable L/C

2. Confirmed L/C/unconfirmed L/C

3. Sight L/C/since L/C

4. Transferable L/C/untransferable L/C

5. Divisible L/C/indivisible L/C

6. Revolving L/C

7. L/C with T/T reimbursement clause

8. Without recourse L/C/with recourse L/C

9. Documentary L/C/clean L/C

10. Deferred payment L/C/anticipatory L/C

11. Back to back L/Reciprocal L/C

12. TSraveller's L/C(or: circular L/C)

1. Unconfirmed LC:

If your credit is unconfirmed neither the advising bank or any nominated bank commits to pay under the credit. Therefore no cash cover is required at the point of establishing the LC, saving possible interest charge on borrowed funds. Payment can be made to the supplier at any time within the validity of the LC, before or after shipment as agreed by both the buyer and seller. Unconfirmed LC also eliminates the ˜confirmation charge" which is the most significant overseas bank charge.

2. Documentary L.C:

A documentary L.C is one which provides for bills to be accompanied by the documents of title to goods. Such as bill of lading, invoice and the marine insurance policy of insurance etc

3. Clean letter of credit:

If there is no condition attach to the bill and the issuing bank makes payment up to a limit of credit, the letter of credit is called clean or open letter of credit. It is payable to the exporter according to his will.

4. Fix Letter of credit:

The amount of this type of letter of credit remains the same within a fix period. When the original fixed amount is used fresh credit is necessary. In other words, a fixed L.C. is that which is available for a fixed total amount payable in one or more than one drafts.

5. Confirmed LC:

Confirmation of LC could be backed by dollar or local currency borrowings or by outright payment of cash. The LC may be confirmed from the beginning of the transaction or at any point in the life of the LC.

6. Revolving LC:

If you deal with a particular supplier on a very regular basis, you may save administrative time, effort and bank charges by setting up a revolving credit. This can be set up to revolve either by time or amount to mirror workflow, such as production runs or growth seasons. The major advantage being the savings made in local bank charges by grouping various LC under one Revolving LC.

7. Standby LC:

Like a bank guarantee, a standby LC is payable on first demand, usually against the beneficiary's simple declaration of non-performance, accompanied by minimal support documentation. This offers the seller maximum control over the claims process. This is ideal for contracts involving regular monthly/periodic shipments. The supplier may wish to be secured against default in payment in open account trading or Bills for collection. Standby LC reduces the bank charges associated with LC transactions, while still providing maximum security for the supplier on various shipments. No cash cover is required for import transactions and payments are made when due eliminating both interest expense and exchange rate risk. Standby LC combines the security associated with LC with the flexibility and reduced cost associated with Bills for collection transactions.

8. An irrevocable LC:

An irrevocable LC cannot be changed unless both the buyer and seller agree. Whereas in a revocable LC changes to the LC can be made without the consent of the beneficiary. A 'sight' LC means that payment is made immediately to the beneficiary/seller/exporter upon presentation of the correct documents in the required time frame. A 'time' or 'date' LC will specify when payment will be made at a future date and upon presentation of the required documents.

If your credit is unconfirmed neither the advising bank or any nominated bank commits to pay under the credit. Therefore no cash cover is required at the point of establishing the LC, saving possible interest charge on borrowed funds. Payment can be made to the supplier at any time within the validity of the LC, before or after shipment as agreed by both the buyer and seller. Unconfirmed LC also eliminates the ˜confirmation charge" which is the most significant overseas bank charge.

2. Documentary L.C:

A documentary L.C is one which provides for bills to be accompanied by the documents of title to goods. Such as bill of lading, invoice and the marine insurance policy of insurance etc

3. Clean letter of credit:

If there is no condition attach to the bill and the issuing bank makes payment up to a limit of credit, the letter of credit is called clean or open letter of credit. It is payable to the exporter according to his will.

4. Fix Letter of credit:

The amount of this type of letter of credit remains the same within a fix period. When the original fixed amount is used fresh credit is necessary. In other words, a fixed L.C. is that which is available for a fixed total amount payable in one or more than one drafts.

5. Confirmed LC:

Confirmation of LC could be backed by dollar or local currency borrowings or by outright payment of cash. The LC may be confirmed from the beginning of the transaction or at any point in the life of the LC.

6. Revolving LC:

If you deal with a particular supplier on a very regular basis, you may save administrative time, effort and bank charges by setting up a revolving credit. This can be set up to revolve either by time or amount to mirror workflow, such as production runs or growth seasons. The major advantage being the savings made in local bank charges by grouping various LC under one Revolving LC.

7. Standby LC:

Like a bank guarantee, a standby LC is payable on first demand, usually against the beneficiary's simple declaration of non-performance, accompanied by minimal support documentation. This offers the seller maximum control over the claims process. This is ideal for contracts involving regular monthly/periodic shipments. The supplier may wish to be secured against default in payment in open account trading or Bills for collection. Standby LC reduces the bank charges associated with LC transactions, while still providing maximum security for the supplier on various shipments. No cash cover is required for import transactions and payments are made when due eliminating both interest expense and exchange rate risk. Standby LC combines the security associated with LC with the flexibility and reduced cost associated with Bills for collection transactions.

8. An irrevocable LC:

An irrevocable LC cannot be changed unless both the buyer and seller agree. Whereas in a revocable LC changes to the LC can be made without the consent of the beneficiary. A 'sight' LC means that payment is made immediately to the beneficiary/seller/exporter upon presentation of the correct documents in the required time frame. A 'time' or 'date' LC will specify when payment will be made at a future date and upon presentation of the required documents.

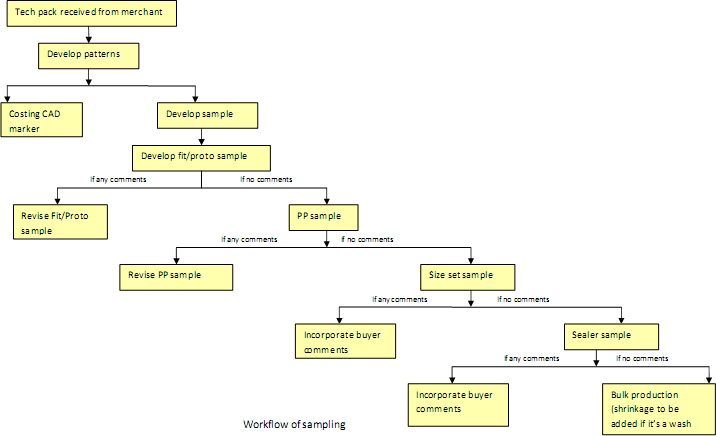

Step-by-step process:

- Buyer and seller agree to conduct business. The seller wants a letter of credit to guarantee payment.

- Buyer applies to his bank for a letter of credit in favor of the seller.

- Buyer's bank approves the credit risk of the buyer, issues and forwards the credit to its correspondent bank (advising or confirming). The correspondent bank is usually located in the same geographical location as the seller (beneficiary).

- Advising bank will authenticate the credit and forward the original credit to the seller (beneficiary).

- Seller (beneficiary) ships the goods, then verifies and develops the documentary requirements to support the letter of credit. Documentary requirements may vary greatly depending on the perceived risk involved in dealing with a particular company.

- Seller presents the required documents to the advising or confirming bank to be processed for payment.

- Advising or confirming bank examines the documents for compliance with the terms and conditions of the letter of credit.

- If the documents are correct, the advising or confirming bank will claim the funds by:

- Advising or confirming bank will forward the documents to the issuing bank.

Issuing bank will examine the documents for compliance. If they are in order, the issuing bank will debit the buyer's account.

- Issuing bank then forwards the documents to the buyer.

- Buyer and seller agree to conduct business. The seller wants a letter of credit to guarantee payment.

- Buyer applies to his bank for a letter of credit in favor of the seller.

- Buyer's bank approves the credit risk of the buyer, issues and forwards the credit to its correspondent bank (advising or confirming). The correspondent bank is usually located in the same geographical location as the seller (beneficiary).

- Advising bank will authenticate the credit and forward the original credit to the seller (beneficiary).

- Seller (beneficiary) ships the goods, then verifies and develops the documentary requirements to support the letter of credit. Documentary requirements may vary greatly depending on the perceived risk involved in dealing with a particular company.

- Seller presents the required documents to the advising or confirming bank to be processed for payment.

- Advising or confirming bank examines the documents for compliance with the terms and conditions of the letter of credit.

- If the documents are correct, the advising or confirming bank will claim the funds by:

- Debiting the account of the issuing bank.

- Waiting until the issuing bank remits, after receiving the documents.

- Reimburse on another bank as required in the credit.

- Advising or confirming bank will forward the documents to the issuing bank.

Issuing bank will examine the documents for compliance. If they are in order, the issuing bank will debit the buyer's account.

- Issuing bank then forwards the documents to the buyer.

Letter of Credit(L/C) Work Flowchart for Garments Manufacturing Business | Letter of Credit Operation Procedures

Advertisements

A Letter of Credit is a payment term generally used for international sales transactions. It is basically a mechanism, which allows importers/buyers to offer secure terms of payment to exporters/sellers in which a bank (or more than one bank) gets involved. The technical term for Letter of credit is 'Documentary Credit'. At the very outset one must understand is that Letters of credit deal in documents, not goods. The idea in an international trade transaction is to shift the risk from the actual buyer to a bank. Thus a LC (as it is commonly referred to) is a payment undertaking given by a bank to the seller and is issued on behalf of the applicant i.e. the buyer. The Buyer is the Applicant and the Seller is the Beneficiary. The Bank that issues the LC is referred to as the Issuing Bank which is generally in the country of the Buyer. The Bank that Advises the LC to the Seller is called the Advising Bank which is generally in the country of the Seller.

A Letter of Credit is a payment term generally used for international sales transactions. It is basically a mechanism, which allows importers/buyers to offer secure terms of payment to exporters/sellers in which a bank (or more than one bank) gets involved. The technical term for Letter of credit is 'Documentary Credit'. At the very outset one must understand is that Letters of credit deal in documents, not goods. The idea in an international trade transaction is to shift the risk from the actual buyer to a bank. Thus a LC (as it is commonly referred to) is a payment undertaking given by a bank to the seller and is issued on behalf of the applicant i.e. the buyer. The Buyer is the Applicant and the Seller is the Beneficiary. The Bank that issues the LC is referred to as the Issuing Bank which is generally in the country of the Buyer. The Bank that Advises the LC to the Seller is called the Advising Bank which is generally in the country of the Seller.The specified bank makes the payment upon the successful presentation of the required documents by the seller within the specified time frame. Note that the Bank scrutinizes the 'documents' and not the 'goods' for making payment. Thus the process works both in favor of both the buyer and the seller. The Seller gets assured that if documents are presented on time and in the way that they have been requested on the LC the payment will be made and Buyer on the other hand is assured that the bank will thoroughly examine these presented documents and ensure that they meet the terms and conditions stipulated in the LC.

Typically the documents requested in a Letter of Credit are the following:

1.L/c application from

2.Valid trade license.

3.Import registration corticated (lrc)

4.Tin or inmates declaration

5.Memorandum of association

6.Indent pr Performa Invoice

7.Photographs

8.Bank gurrntee certificate

9.Agreement form

10.Insurance coverage

11.Commercial invoice

12.Transport document such as a Bill of lading or Airway bill,

13. Insurance document;

14.Inspection Certificate

15.Certificate of Origin

But there could be others too.

Letters of credit (LC) deal in documents, not goods. The LC could be 'irrevocable' or 'revocable'. An irrevocable LC cannot be changed unless both the buyer and seller agree. Whereas in a revocable LC changes to the LC can be made without the consent of the beneficiary. A 'sight' LC means that payment is made immediately to the beneficiary/seller/exporter upon presentation of the correct documents in the required time frame. A 'time' or 'date' LC will specify when payment will be made at a future date and upon presentation of the required documents.

Essential Principles Governing Law Within the United States, Article 5 of the Uniform Commercial Code (UCC) governs L/Cs. Article 5 is founded on two principles:

(1) the L/C,s independence from the underlying business transaction, and

(2) strict compliance with documentary requirements.

1) Strict Compliance

How strict compliance? Some courts insist upon literal compliance, so that a misspelled name or typographical error voids the exporter's/beneficiary's/seller's demand for payment. Other courts require payment upon substantial compliance with documentary requirements. The bank may insist upon strict compliance with the requirements of the L/C. In the absence of conformity with the L/C, the Seller cannot force payment and the bank pays at its own risk. Sellers should be careful and remember that the bank may insist upon strict compliance with all documentary requirements in the LC. If the documents do not conform, the bank should give the seller prompt, detailed notice, specifying all discrepancies and shortfalls.

2) The Independence Doctrine

Letters of credit deal in documents, not goods. L/Cs are purely documentary transactions, separate and independent from the underlying contract between the Buyer and the Seller. The bank honoring the L/C is concerned only to see that the documents conform with the requirements in the L/C. If the documents conform, the bank will pay, and obtain reimbursement from the Buyer/Applicant. The bank need not look past the documents to examine the underlying sale of merchandise or the product itself. The letter of credit is independent from the underlying transaction and, except in rare cases of fraud or forgery, the issuing bank must honor conforming documents. Thus, Sellers are given protections that the issuing bank must honor its demand for payment (which complies with the terms of the L/C) regardless of whether the goods conform with the underlying sale contract.

3 Most Common Reasons why Letters of Credit Fail

1) Time Lines:

The letter of credit should have an expiration date that gives sufficient time to the seller to get all the tasks specified and the documents required in the LC. If the letter of credit expires, the seller is left with no protection. Most LC s fail because Sellers/Exporters/Beneficiaries were unable to perform within the specified time frame in the LC. Three dates are of importance in an LC:

a) The date by when shipment should have occurred. The date on the Bill of Lading.

b) The date by when documents have to be presented to the Bank

c) The expiry date of the LC itself.

A good source to give you an idea of the timelines would be your freight forwarding agent. As a seller check with your freight forwarding agent to see if you would be in a position to comply.

2) Discrepancy within the Letter of Credit:

Letters of credit could also have discrepancies. Even a discrepancy as small as a missing period or comma can render the document invalid. Thus, the earlier in the process the letter of credit is examined, the more time is available to identify and fix the problem. This is another common reason why LCs fail.

3) Compliance with the Documents and Conditions within the Letter of Credit.

Letters of credit are about documents and not facts; the inability to produce a given document at the right time will nullify the letter of credit. As a Seller/Exporter/Beneficiary you should try and run the compliance issues with the various department or individuals involved within your organization to see if compliance would be a problem. And if so, have the LC amended before shipping the goods.

Learning the Terminology of Exporting

INCOTERMS (TRANSPORTATION)

Shipping terms set the parameters for international shipments, specify points of origin and destination, outline conditions under which title is transferred from seller to buyer, and determine which party is responsible for shipping costs. They also indicate which party assumes the cost if merchandise is lost or damaged during transit. To provide a common terminology for international shipping, INCOTERMS (International Commercial Terms) have been developed under the auspices of the International Chamber of Commerce.

All letters of credit contain these elements:

- A payment undertaking given by the bank (issuing bank)

- On behalf of the buyer (applicant)

- To pay a seller (beneficiary)

- A given amount of money

- On presentation of specified documents representing the supply of goods

- Within specific time limits

- These documents conforming to terms and conditions set out in the letter of credit

- Documents to be presented at a specified place.

The stages of the letter of credit:

1. Buyer and seller agree terms, including means of transport, period of credit offered (if any), latest date of shipment, Incomer to be used

2. Buyer applies to bank for issue of letter of credit. Bank will evaluate buyer's credit standing, and may require cash cover and/or reduction of other lending limits

3. Issuing bank issues L/C, sending it to the Advising bank by airmail or (more commonly) electronic means such as telex or SWIFT

4. Advising bank establishes authenticity of the letter of credit using signature books or test codes, then informs seller (beneficiary). Advising bank MAY confirm L/C, i.e. add its own payment undertaking

5. Seller should now check that L/C matches commercial agreement, and that all its terms and conditions can be satisfied, (e.g. all documents can be obtained in good time.) If there is anything that may cause a problem, an AMENDMENT must be requested.

6. Seller ships the goods, then assembles the documents called for the L/C (invoice, transport document etc.) Before presenting the documents to the bank, the seller should check them for discrepancies with the L/C, and correct the documents where necessary.

7. The documents are presented to a bank, often the Advising bank. The Advising bank checks the documents against the L/C. If the documents are compliant, the bank pays the seller and forwards the documents to the Issuing bank

8. The Issuing bank now checks the documents itself. If they are in order (and it is a sight L/C), it reimburses the seller's bank immediately

9. The Issuing bank debits the buyer and releases the documents (including transport document), so that the buyer can claim the goods from the carrier.

Different kinds of L/C :

1. Revocable L/C/irrevocable L/C

2. Confirmed L/C/unconfirmed L/C

3. Sight L/C/since L/C

4. Transferable L/C/untransferable L/C

5. Divisible L/C/indivisible L/C

6. Revolving L/C

7. L/C with T/T reimbursement clause

8. Without recourse L/C/with recourse L/C

9. Documentary L/C/clean L/C

10. Deferred payment L/C/anticipatory L/C

11. Back to back L/Reciprocal L/C

12. TSraveller's L/C(or: circular L/C)

1. Unconfirmed LC:

If your credit is unconfirmed neither the advising bank or any nominated bank commits to pay under the credit. Therefore no cash cover is required at the point of establishing the LC, saving possible interest charge on borrowed funds. Payment can be made to the supplier at any time within the validity of the LC, before or after shipment as agreed by both the buyer and seller. Unconfirmed LC also eliminates the ˜confirmation charge" which is the most significant overseas bank charge.

2. Documentary L.C:

A documentary L.C is one which provides for bills to be accompanied by the documents of title to goods. Such as bill of lading, invoice and the marine insurance policy of insurance etc

3. Clean letter of credit:

If there is no condition attach to the bill and the issuing bank makes payment up to a limit of credit, the letter of credit is called clean or open letter of credit. It is payable to the exporter according to his will.

4. Fix Letter of credit:

The amount of this type of letter of credit remains the same within a fix period. When the original fixed amount is used fresh credit is necessary. In other words, a fixed L.C. is that which is available for a fixed total amount payable in one or more than one drafts.

5. Confirmed LC:

Confirmation of LC could be backed by dollar or local currency borrowings or by outright payment of cash. The LC may be confirmed from the beginning of the transaction or at any point in the life of the LC.

6. Revolving LC:

If you deal with a particular supplier on a very regular basis, you may save administrative time, effort and bank charges by setting up a revolving credit. This can be set up to revolve either by time or amount to mirror workflow, such as production runs or growth seasons. The major advantage being the savings made in local bank charges by grouping various LC under one Revolving LC.

7. Standby LC:

Like a bank guarantee, a standby LC is payable on first demand, usually against the beneficiary's simple declaration of non-performance, accompanied by minimal support documentation. This offers the seller maximum control over the claims process. This is ideal for contracts involving regular monthly/periodic shipments. The supplier may wish to be secured against default in payment in open account trading or Bills for collection. Standby LC reduces the bank charges associated with LC transactions, while still providing maximum security for the supplier on various shipments. No cash cover is required for import transactions and payments are made when due eliminating both interest expense and exchange rate risk. Standby LC combines the security associated with LC with the flexibility and reduced cost associated with Bills for collection transactions.

8. An irrevocable LC:

An irrevocable LC cannot be changed unless both the buyer and seller agree. Whereas in a revocable LC changes to the LC can be made without the consent of the beneficiary. A 'sight' LC means that payment is made immediately to the beneficiary/seller/exporter upon presentation of the correct documents in the required time frame. A 'time' or 'date' LC will specify when payment will be made at a future date and upon presentation of the required documents.

If your credit is unconfirmed neither the advising bank or any nominated bank commits to pay under the credit. Therefore no cash cover is required at the point of establishing the LC, saving possible interest charge on borrowed funds. Payment can be made to the supplier at any time within the validity of the LC, before or after shipment as agreed by both the buyer and seller. Unconfirmed LC also eliminates the ˜confirmation charge" which is the most significant overseas bank charge.

2. Documentary L.C:

A documentary L.C is one which provides for bills to be accompanied by the documents of title to goods. Such as bill of lading, invoice and the marine insurance policy of insurance etc

3. Clean letter of credit:

If there is no condition attach to the bill and the issuing bank makes payment up to a limit of credit, the letter of credit is called clean or open letter of credit. It is payable to the exporter according to his will.

4. Fix Letter of credit:

The amount of this type of letter of credit remains the same within a fix period. When the original fixed amount is used fresh credit is necessary. In other words, a fixed L.C. is that which is available for a fixed total amount payable in one or more than one drafts.

5. Confirmed LC:

Confirmation of LC could be backed by dollar or local currency borrowings or by outright payment of cash. The LC may be confirmed from the beginning of the transaction or at any point in the life of the LC.

6. Revolving LC:

If you deal with a particular supplier on a very regular basis, you may save administrative time, effort and bank charges by setting up a revolving credit. This can be set up to revolve either by time or amount to mirror workflow, such as production runs or growth seasons. The major advantage being the savings made in local bank charges by grouping various LC under one Revolving LC.

7. Standby LC:

Like a bank guarantee, a standby LC is payable on first demand, usually against the beneficiary's simple declaration of non-performance, accompanied by minimal support documentation. This offers the seller maximum control over the claims process. This is ideal for contracts involving regular monthly/periodic shipments. The supplier may wish to be secured against default in payment in open account trading or Bills for collection. Standby LC reduces the bank charges associated with LC transactions, while still providing maximum security for the supplier on various shipments. No cash cover is required for import transactions and payments are made when due eliminating both interest expense and exchange rate risk. Standby LC combines the security associated with LC with the flexibility and reduced cost associated with Bills for collection transactions.

8. An irrevocable LC:

An irrevocable LC cannot be changed unless both the buyer and seller agree. Whereas in a revocable LC changes to the LC can be made without the consent of the beneficiary. A 'sight' LC means that payment is made immediately to the beneficiary/seller/exporter upon presentation of the correct documents in the required time frame. A 'time' or 'date' LC will specify when payment will be made at a future date and upon presentation of the required documents.

Step-by-step process:

- Buyer and seller agree to conduct business. The seller wants a letter of credit to guarantee payment.

- Buyer applies to his bank for a letter of credit in favor of the seller.

- Buyer's bank approves the credit risk of the buyer, issues and forwards the credit to its correspondent bank (advising or confirming). The correspondent bank is usually located in the same geographical location as the seller (beneficiary).

- Advising bank will authenticate the credit and forward the original credit to the seller (beneficiary).

- Seller (beneficiary) ships the goods, then verifies and develops the documentary requirements to support the letter of credit. Documentary requirements may vary greatly depending on the perceived risk involved in dealing with a particular company.

- Seller presents the required documents to the advising or confirming bank to be processed for payment.

- Advising or confirming bank examines the documents for compliance with the terms and conditions of the letter of credit.

- If the documents are correct, the advising or confirming bank will claim the funds by:

- Advising or confirming bank will forward the documents to the issuing bank.

Issuing bank will examine the documents for compliance. If they are in order, the issuing bank will debit the buyer's account.

- Issuing bank then forwards the documents to the buyer.

- Buyer and seller agree to conduct business. The seller wants a letter of credit to guarantee payment.

- Buyer applies to his bank for a letter of credit in favor of the seller.

- Buyer's bank approves the credit risk of the buyer, issues and forwards the credit to its correspondent bank (advising or confirming). The correspondent bank is usually located in the same geographical location as the seller (beneficiary).

- Advising bank will authenticate the credit and forward the original credit to the seller (beneficiary).

- Seller (beneficiary) ships the goods, then verifies and develops the documentary requirements to support the letter of credit. Documentary requirements may vary greatly depending on the perceived risk involved in dealing with a particular company.

- Seller presents the required documents to the advising or confirming bank to be processed for payment.

- Advising or confirming bank examines the documents for compliance with the terms and conditions of the letter of credit.

- If the documents are correct, the advising or confirming bank will claim the funds by:

- Debiting the account of the issuing bank.

- Waiting until the issuing bank remits, after receiving the documents.

- Reimburse on another bank as required in the credit.

- Advising or confirming bank will forward the documents to the issuing bank.

Issuing bank will examine the documents for compliance. If they are in order, the issuing bank will debit the buyer's account.

- Issuing bank then forwards the documents to the buyer.

Advertisements